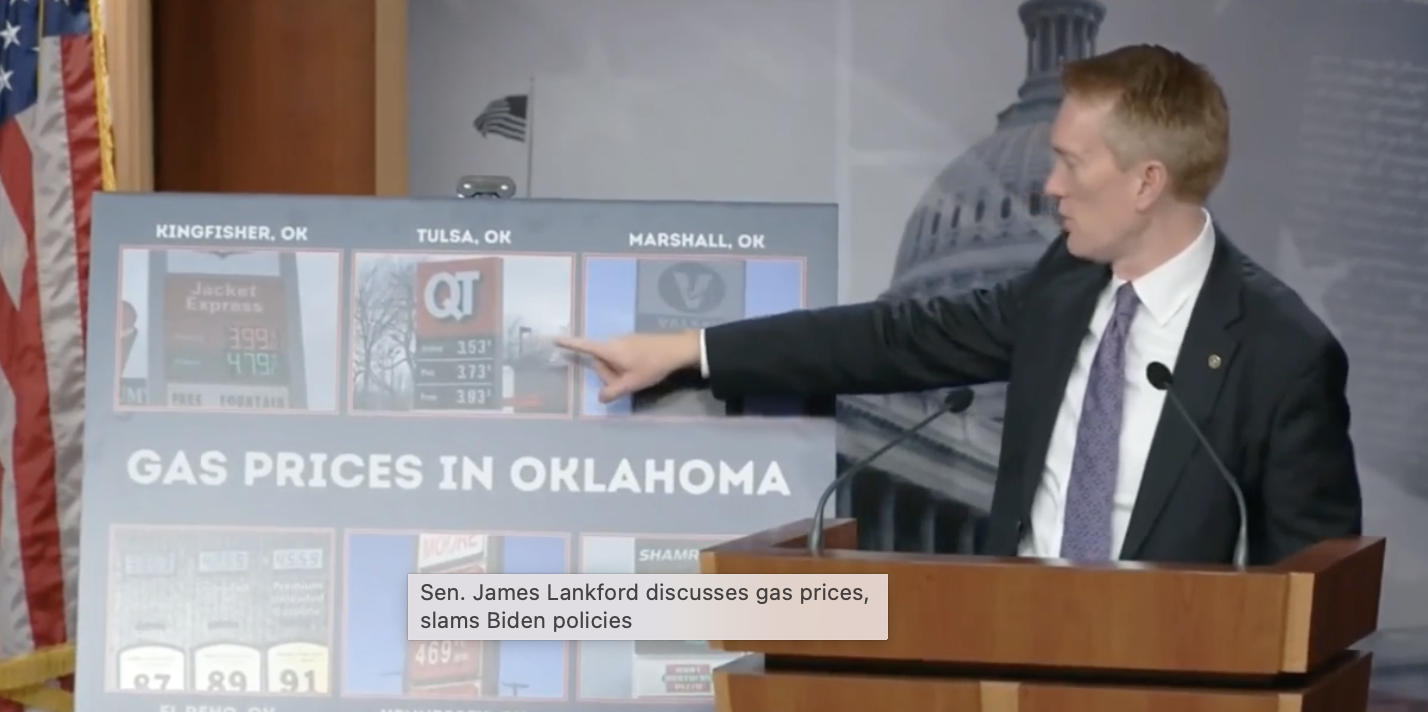

Watch Now: Lankford, Republicans rebut Democrats’ message on fuel prices

April 7, 2022

From TulsaWorld.com

By Randy Krehbiel

Democrats in the U.S. House of Representatives lashed oil executives on Wednesday for higher gasoline prices while Senate Republicans, led by U.S. Sen. James Lankford, stoked the notion that President Joe Biden is to blame.

“This is not a result of Putin’s war,” Lankford said in leading off a Republican press conference apparently scheduled in opposition to the House hearing. “This is a result of Biden policies, and everyone knows it. They can try to change the subject all they want to, but everyone knows this is a direct result of the Biden policies.”

Meanwhile, the House Energy and Commerce Committee grilled six oil and gas executives, including former Tulsan Richard Muncrief, who is now president and chief executive officer of Oklahoma City-based Devon Energy.

“At a time of record profits, Big Oil is refusing to increase production to provide the American people some much-needed relief at the gas pump,” said committee Chairman Frank Pallone, a New Jersey Democrat.

Gasoline prices have actually started to recede from last month’s record high but remain volatile — well above those of a year ago and far above the pandemic lows of 2020.

The national average gas price was $4.16 a gallon for regular on Wednesday, up from $2.87 a year ago, according to AAA.

The executives told the House committee they don’t set prices.

“We do not control the market price of crude oil or natural gas, nor of refined products like gasoline and diesel fuel, and we have no tolerance for price gouging,” said Chevron CEO Mike Wirth.

Democrats have sought to blame higher fuel prices on Russian President Vladimir Putin’s attack on Ukraine, which has affected supplies from both those countries and created global political uncertainty, as well as price gouging by the oil and gas industry.

“There is a way to produce more American energy,” Lankford said. “There is a way to be able to bring prices down. (Democrats) are just not willing to do it at this point.”

Among the moves criticized by Lankford and the Republicans was Biden’s decision to release 1 million barrels of oil per day for six months from the nation’s 700 million-barrel strategic petroleum reserve.

ExxonMobil CEO Darren Woods told the committee that his company stands with communities around the world “in deploring Russia’s aggression and the devastation it has inflicted on the Ukrainian people.” Exxon has halted investments in Russia and is withdrawing from operations there, Woods said.

Exxon is increasing production in the United States, Woods said, including in the oil-rich Permian Basin in New Mexico and Texas. The company also is increasing production outside the U.S., including “a world-class development in Guyana,” Woods said.

“The bottom line is if we want lower gas prices we need to have more oil supply right now,” Biden said last week. “This is a moment of consequence and peril for the world and pain at the pump for American families.”

Higher prices have hurt Biden’s approval domestically and added billions of oil-export dollars to the Russian government as it wages war on Ukraine.

The release of oil from the U.S. stockpile could reduce oil prices, although Biden has twice ordered releases from the reserves without causing a meaningful shift in oil markets. Biden said last week that he expects that gasoline prices could drop “fairly significantly.”

Oil companies have pledged to boost domestic production, but it is growing slowly. Executives point to supply chain and labor constraints, as well as investor demands for returns, and have called for more federal permits to allow additional leases.

Under questioning from Pallone, Woods and other CEOs said oil companies have no plans to halt payments of dividends to stockholders or to restrict stock buybacks that have enriched shareholders and company executives. The six companies at the hearing recorded $77 billion in profit last year, they told Pallone.